Lessons from Asia Pacific

As we adapt and improvise to overcome a dynamic and unfolding set of challenging circumstances one may be surprised by the volume (noise and quantum) of unhelpful chatter and lightweight content on social and not-so-social media channels right now. There’s a lot of pointing out and shouting, but a marked absence of considered analysis and deduction to address the ‘so what’ question. Hearing how my colleagues in markets and economies ahead of us on the COVID-19 curve have continued to go about their business struck me as being useful perspective to share.

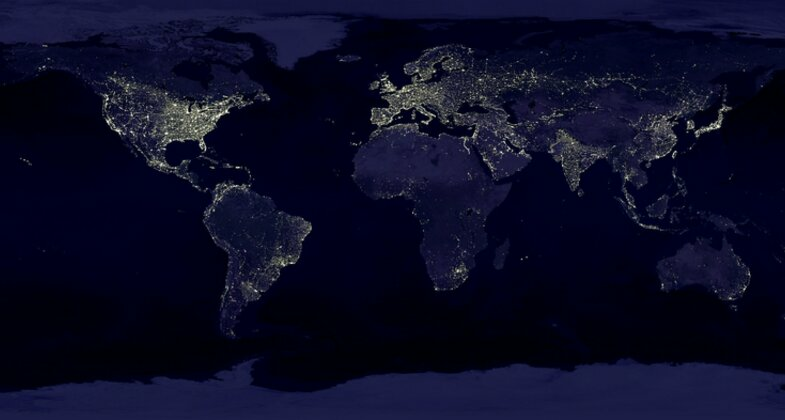

One of our defining features at Odgers Berndtson is that of being global. Beyond scale and reach, it offers a range of perspectives informed by different cultures, economies and communities. Occasionally, it can be a gritty oyster, but it absolutely guards against ‘group-think’. We learn from each other and each other’s markets. It’s part and parcel of what makes up search intelligence – our stock in trade – and informs the leadership judgements and advice we offer across continents and economies. Edge, if you will.

To address some of the ‘so what’ of COVID-19 impact, then, let’s turn to what we can learn from our colleagues in Asia Pacific who have been dealing with COVID-19 for longer than the rest of the World.

The Virus

China’s response to the outbreak comprised strict lockdown measures in Wuhan in a way no country in the West has attempted to replicate. In late January, China implemented country-wide lockdown rules similar to those we now have in the UK. No gradual tightening – just a one-hit, rule of law lockdown. SARS is still comparatively recent history, so the population knew what to do. This fast response brought the peak under control quickly across China.

By mid-February, Singapore and Hong Kong became hot spots. Infected tourists from China travelled there for the Chinese New Year holiday and started the community spread. Containment was swift and effective in populations, mostly compliant and with experience of SARS.

As COVID-19 became a global pandemic, citizens of China, Singapore and Hong Kong who were overseas and avoiding going home because of the virus have since returned home in the past month. Home countries are now regarded as safer than being in the West. This has brought a second wave of infections to those countries; a tenfold increase in Singapore and Hong Kong. China has also seen an increase, but mostly within the quarantine sites.

Singapore and Hong Kong have implemented a lockdown similar to the arrangements here in the UK. Despite initial containment, stricter measures have now been enacted and full lockdown is expected shortly. Australia, Japan and India are on a similar infection trajectory with Government intervention and/or lockdown comparable to the UK’s approach.

Against a backdrop of strict Government diktats which set out best practice and made sense, there is much we can learn and apply from our approach in APAC. The actions we took then are no different from what we are now doing in all our offices globally.

The economic & business impacts

China

Following lockdown, we found that clients did not cancel searches and expected/allowed us to continue. There was a significant slowing of new searches. Once we reached short-list on existing projects, clients would go through the candidate interviews by video and then put the search on hold, as they were not willing to make a final decision to hire without a face-to-face meeting.

The lockdown lasted five weeks and our team started to return to the office in the second week of March. Today, some staff are still choosing to work from home, those coming to the office practise social distancing and wear masks. Business has begun to resume, and people are starting to meet face-to-face again in line with appropriate guidance.

China is not yet back to normal and the virus still threatens a surge of new infections if people do not continue to be vigilant. There are people who will not return to their workplace. Local demand is soft. China initially expected a V-shaped recovery when they had got the virus under control. Now this is a global pandemic, there is a slump in external demand, so China is making slower progress up the recovery curve.

Hong Kong

We have been busy in Hong Kong during this period because much of our business is with Government agencies. The political turmoil from mid-2019 has been a more significant driver than COVID-19. Any deployment of massive stimulus measures will likely create demand for search in Government everywhere.

Singapore, Japan, Australia and India

These countries were largely operating as ‘business as usual’ until recently. Working from home started in mid-March – around the same time as in the UK. After a strong start to the calendar year there was a marked dip in confidence across the Region on or around 21/22 March.

The expectation is for a comparable scenario to China; the volume of new work drops off sharply for at least six weeks, as clients adjust to a new world and then pace, and confidence gradually return.

Business Support

No country in APAC is yet providing the business-focused support which has appeared in the UK although China are just starting to talk about some form of stimulus. In Australia, the focus has been financial support for out of work people with little to support business. The last fortnight has seen massive layoffs. The economic shock of this instant rise in unemployment saps confidence. India and Hong Kong are likely to follow suit, while Singapore and Japan are yet to show the detail of any support measures.

In conclusion – or more ‘so what’

Ultimately, from an economic and business impact, what we see playing out in APAC is completely in sync with the UK, Europe and the US. ‘Mind-set over Skillset’ and ‘Leadership Disrupted’ have been recurrent themes round the Firm for the last couple of years. We now have the biggest disruption that we, our clients and candidates have ever seen – it’s been in APAC for a while and we are feeling the effects now. Many businesses will fail, and it is hard to disagree with the McKinsey view that the business world will be changed forever because of COVID-19, but the business world will not end, and leaders everywhere are working hard to adapt. Every organisation will fight to survive and to create new competitive differentiators.

As tough as it may be for all of us, there will be significant opportunity ahead. Organisations will re-engineer business models and need different leadership to define and drive success in the new normal. Strong, well-led and well-motivated organisations will survive and thrive on the other side. It seems to me that it will take courage, resilience, agility and every bit of intelligent hustle we can all deploy to realise those opportunities.

For more information, please contact Jonathan Clark, Partner and head of our Public Sector practice.